U.S. Ethereum Spot ETF Sees Strong Inflows on First Day of Trading

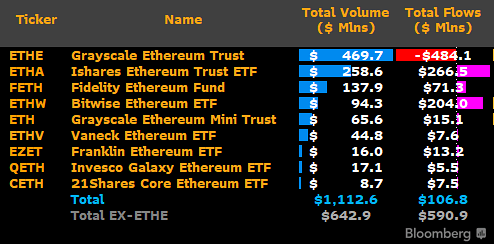

The inaugural transaction in the U.S. spot Ethereum exchange-traded fund market resulted in a net inflow of $106.7 million. BlackRock’s ETHA emerged as the top performer with $266.5 million in inflows, while Grayscale’s ETHE experienced the largest outflows.

Nine spot ETFs officially launched on July 23 after receiving approval from the U.S. Securities and Exchange Commission following the completion of regulatory filings. Among these, BlackRock’s iShares Ethereum Trust led the inflows with a total trading volume surpassing $1 billion, while Grayscale’s Ethereum Trust faced substantial outflows.

Net Inflows and Outflows Breakdown

BlackRock’s ETHA saw significant demand, attracting $266.5 million on the first day. Bitwise’s ETHW followed closely with $204 million in inflows, ranking second, and Fidelity’s FETH secured the third spot with $71.3 million in inflows.

On the flip side, Grayscale’s ETHE experienced outflows of $484.1 million. However, the company’s Ethereum Mini Trust ETH observed modest inflows of $15.1 million. Other notable funds included Franklin Templeton’s EZET at $13.2 million, VanEck’s ETHV at $7.6 million, 21Shares’ CETH at $7.5 million, and Invesco Galaxy’s QETH at $5.5 million.

Transaction Volume Surpasses $1 Billion

Data from Bloomberg ETF analyst James Seyffart revealed that the total trading volume of these ETFs exceeded $1.1 billion. Excluding the $469 million in ETH trading volume, the remaining eight inflows amounted to approximately $642 million.

Furthermore, total inflows minus ETH outflows surpassed $590.9 million, indicating a strong reception for the new U.S. Ethereum spot ETFs.

Seyffart described the overall performance of U.S. Ethereum spot ETFs on their first day as “very fulfilling,” according to data from SoSoValue. As of July 23, the ETFs’ total net assets reached $10.24 billion, representing approximately 2.45% of Ethereum’s $413 billion market capitalization.